Government works best when it is monitored by its citizens. One way that’s done is through elections. The municipal election happens every fall on the first Tuesday in October. This year it’s on October 3. Unfortunately, over the past 20 years, voting has trended downward. In the past five years, the City and Borough of Juneau has had an average of 6,761 votes cast; 20 years ago, the five year average was 9,729. Ballot propositions tend to draw out more voters. This year, there are two.

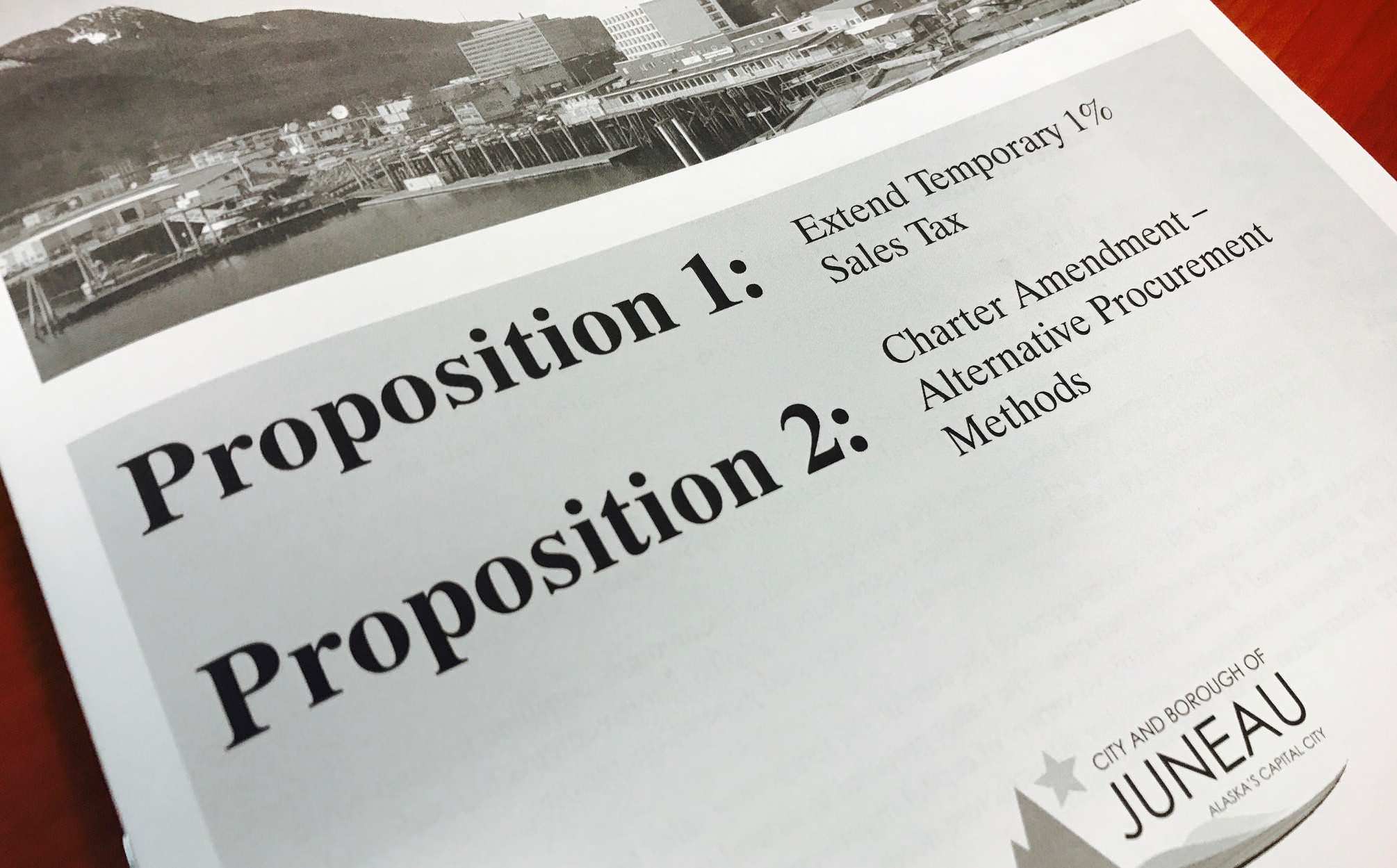

The two propositions on this year’s ballot are related to construction project expenditures. The first is a proposed extension of CBJ’s temporary 1% sales tax. CBJ has an existing 5% sales tax, of which 1% is permanent, 3% is temporary and an additional 1% is temporary. The temporary portions are temporary on purpose – city government has to regularly check in with the voters and get approval to continue the taxation.

Proposition 1 on the ballot proposes to extend the temporary 1% for another five years and to fund construction projects, also known as capital improvements. Over five years, 1% of sales tax is estimated to collect about $44 million and the money would be allocated to repair and upgrade a variety of municipal facilities including the city’s water and wastewater systems, school facilities, airport, hospital, harbors, parks, Augustus Brown Pool, Centennial Hall, as well as providing funding for CBJ’s recycling and housing programs. The weather, normal operation, and heavy public use wear down buildings and facilities. If approved, the proposition would allow money to be spent to repair, replace, upgrade and modernize these facilities.

Proposition 2 would amend the Charter, which is effectively the local constitution. Currently, the Charter requires construction bids to be awarded to the lowest qualified bidder. If passed, Proposition 2 would amend the Charter to let the Assembly pass ordinances that would authorize alternative procurement methods. In lay speak, this means that construction contracts could be awarded on more criteria than just low bid. The State of Alaska and the Municipality of Anchorage use alternative procurement as do many other government agencies. The intent would be to use this greater flexibility on larger and more complicated projects to try and get better value out of tax payer dollars.

Propositions 1 proposes to continue a portion of CBJ’s sales tax and Proposition 2 would authorize greater flexibility in how the money can be managed. Your votes will decide these matters.

(This is written by the City Manager’s office and originally appeared in the September 15, 2017 Juneau Empire in a segment called, “City Corner”)